- HOME

- Investor Relations

- Management Policies

- Message from the CFO

September 2025

Review of the Fiscal Year Ended March 31, 2025,

and Outlook for the Fiscal Year Ending March 31, 2026

Looking back on the business environment during the fiscal year ended March 31, 2025, we observed restrained consumer spending in Japan due to the soaring prices of food and other goods, and the overall business environment remained challenging due to continued increases in raw material and logistics costs. Nevertheless, we achieved record highs in both net sales and operating income.

There are several key points in analyzing our results for the previous fiscal year. The biggest factor was a significant recovery in sales volume, centered on semiconductor- and electronic component-related products. Against the backdrop of global investment in AI, net sales of semiconductor-related adhesive tapes and equipment, as well as multilayer ceramic capacitor-related tapes—core products of our Advanced Materials perations—reached record-high levels. In addition, overseas subsidiaries generally performed steadily. For example, losses at the MACTAC Group, a U.S. subsidiary, shrank by approximately ¥2 billion year on year. Similarly, our U.S.-based companies MADICO, INC. and VDI, LLC also contributed more to profits than in the past. With overseas sales accounting for approximately 64% and the yen remaining weak, we recorded approximately ¥2.2 billion in operating income.

For the fiscal year ending March 31, 2026, we forecast higher net sales but lower income. One factor behind this profit decline is the impact of foreign exchange rates. Our assumed exchange rate for the current fiscal year is ¥145 to the U.S. dollar, a ¥7 appreciation compared with the previous year’s actual rate. While we expect continued solid performance from overseas subsidiaries that sell adhesive products for seals and labels and semiconductor- and electronic component-related products, there will be an exchange rate impact due to yen appreciation. In addition, increased personnel costs, higher fixed costs including depreciation from new production equipment, and rising raw material and transportation costs are anticipated to negatively impact profits. We plan to steadily accumulate profits through Companywide cost reduction measures.

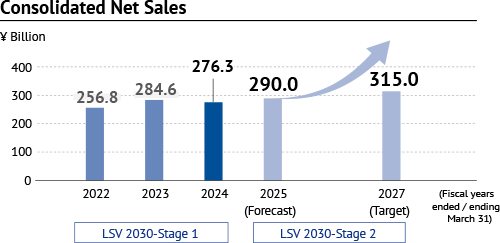

As for net sales, we already achieved the final-year management target of our medium-term business plan, LSV 2030-Stage 2, in the previous fiscal year. As a result of this, we have heard that investors are expecting an upward revision of our medium-term business plan targets. However, considering the performance forecast for the current fiscal year and the continued uncertainty in the business environment, we decided to maintain our targets at the time of the May 2025 earnings announcement. Going forward, we will continue to monitor our business performance and carefully consider revisions to our targets as appropriate.

Promotion of Structural Reforms

Fine & Specialty Paper Products Operations, which recorded impairment losses in the previous fiscal year, continue to face profitability challenges due to persistently high pulp raw prices and declining sales volumes. However, this business also plays a role in manufacturing raw materials for our adhesive business by supplying release base paper internally. Therefore, we recognize that withdrawing or selling this business at this time could risk negatively impacting the profitability of other business operations. However, as we recognize that structural reforms in the business are essential, in July 2025 we decided to take the first step by shutting down one of the paper machines operating at the Kumagaya Plant.

We are also promoting structural reforms in other areas, such as MACTAC AMERICAS, LLC, which belongs to Printing & Variable Information Products Operations, and Optical Products Operations. MACTAC AMERICAS is working on consolidating production and logistics bases and reviewing the supply chain. We expect efficiency gains and cost reductions, and with the roughly ¥4 billion annual burden of amortization of goodwill scheduled to end during the period of our medium-term business plan, we anticipate increased profitability moving forward. In Optical Products Operations, we dissolved LINTEC SPECIALITY FILMS (KOREA), INC. and LINTEC SPECIALITY FILMS (TAIWAN), INC., which had been engaged in the adhesive processing business for polarizing films, during the previous fiscal year. This decision was based on the view that recovery in performance at both locations was unlikely due to the recent rise of Chinese companies in the LCD-related business. Going forward, in Optical Products Operations, we will continue to focus on polarizing film products for organic light- emitting diode displays and promote the expansion of proprietary products, such as adhesive products for in-vehicle displays and light diffusion films, while also steadily working to reduce fixed costs.

Further Improvement of ROE

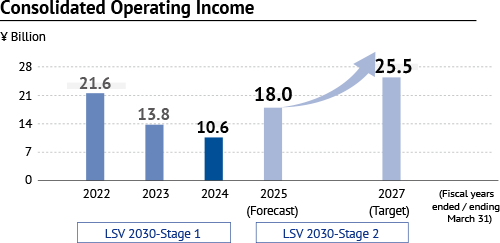

Currently, LINTEC’s price-to-book value ratio (PBR) remains below 1.0, a level that reflects undervaluation, and we recognize the urgent need to establish a proper stock valuation. We estimate that our WACC for the previous fiscal year was around 6%. To consistently achieve a PBR above 1.0, we recognize the importance of consistently generating ROE that exceeds WACC. Under LSV 2030, we have set financial targets of an operating profit margin of 12% or more and ROE of 10% or more, with the aim of improving corporate value over the medium to long term. To achieve this, we will pursue growth in sales and profit margins through structural reforms; enhancement of quality, cost, and delivery; and the early launch of new products and businesses. At the same time, we will work toward continuous improvement in ROE through appropriate capital allocation and agile shareholder returns. In the past, we tended to prioritize sales growth, and there was relatively less focus on profitability and capital efficiency. In fact, we intentionally did not disclose numerical targets for net sales or operating income for the fiscal year ending March 31, 2030, to encourage internal awareness reform.

Furthermore, starting from the fiscal year ended March 31, 2024, we transitioned to a framework in which each business operation analyzes and utilizes its own balance sheet. We have set KPIs for turnover ratios on fixed assets, inventory, and accounts receivable, and we have also begun in earnest to manage our businesses’ ROIC. This enables more precise and agile responses when allocating resources or making strategic decisions. The introduction of KPI management has also led to growing financial awareness, not only within business operations but also in the Production Division, Procurement Division, and Research & Development Division. We are now able to collect financial data from each business operation without delays and have established an appropriate management structure. Going forward, we aim to further enhance operational performance, inventory control, and business efficiency by leveraging DX.

Cash Allocation to Support Sustainable Growth

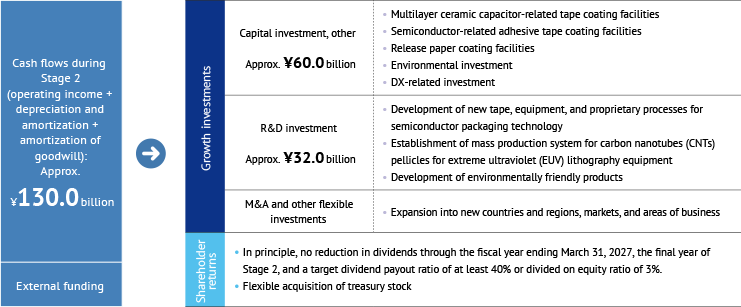

During the period of our medium-term business plan, we anticipate generating approximately ¥130.0 billion in cash flow. We plan to allocate approximately ¥60.0 billion of this toward capital investment. Since the previous medium-term business plan period, we have been working to build capacity to meet rising demand, especially for semiconductor- and electronic component-related products. We accelerated the expansion of production facilities for semiconductor-related adhesive tapes and multilayer ceramic capacitor-related tapes to build a system capable of responding to strong demand. In addition, recognizing the long-term potential of sustained high demand for semiconductor-related equipment, we have launched a project to rebuild the Ina Technology Center, which develops and produces equipment. As a result, capital expenditures in the previous fiscal year exceeded the initial plan and totaled ¥20.6 billion. In today’s rapidly changing environment, the key lies in making timely investments ahead of the curve. We will continue to respond swiftly based on our plans.

We are also planning approximately ¥32.0 billion in R&D expenses. In the first year of the medium-term business plan, we invested a record-high ¥10.1 billion. To promptly achieve our goal of increasing the net sales ratio of new products set as part of our material issues, we are steadily investing in new products and businesses. We are making upfront investments with a focus on semiconductor-related products, including carbon nanotube pellicles for extreme ultraviolet lithography equipment. Regarding M&A, we will continue to evaluate opportunities, particularly with a view to expanding in overseas markets, while carefully considering financial risks.

Regarding shareholder returns, our basic policy through the fiscal year ending March 31, 2027, is to avoid dividend reductions in principle and maintain a dividend payout ratio of 40% or higher or a dividend on equity (DOE) ratio of 3% as a benchmark. In the previous fiscal year, reflecting our strong performance, we raised the annual dividend by ¥12, from the initial forecast of ¥88 to ¥100. For the current fiscal year, we plan to increase the dividend by an additional ¥10 to ¥110, marking the second consecutive year of dividend increases. As part of our shareholder return initiatives, we also executed a share repurchase program beginning in February 2025, with an upper limit of 3 million shares or ¥10 billion. The program was completed in June. While continuing to strengthen our management foundation, we will maintain our fundamental policy of stable and continuous dividends based on each fiscal year’s consolidated performance, and we remain committed to further enhancing shareholder returns.

Constructive Dialogue with Shareholders and Investors

In recent years, during IR meetings with investors we have received many questions regarding the optimization of our business portfolio. LINTEC does not apply blanket rules for investment or withdrawal decisions. This is because we believe that, in a rapidly changing business environment, the ability to accurately assess each situation and make timely decisions allows for flexible responses aligned with individual circumstances. Accordingly, I view it as my important role to communicate clearly and sincerely with shareholders and investors, explaining the background behind our initiatives as well as LINTEC’s thinking and unique strengths. We will continue to strive for improved corporate value and better market recognition through active information disclosure and constructive dialogue.