- HOME

- Investor Relations

- Stock & Bond Information

- Dividend Information

Basic Policies of Shareholder Returns

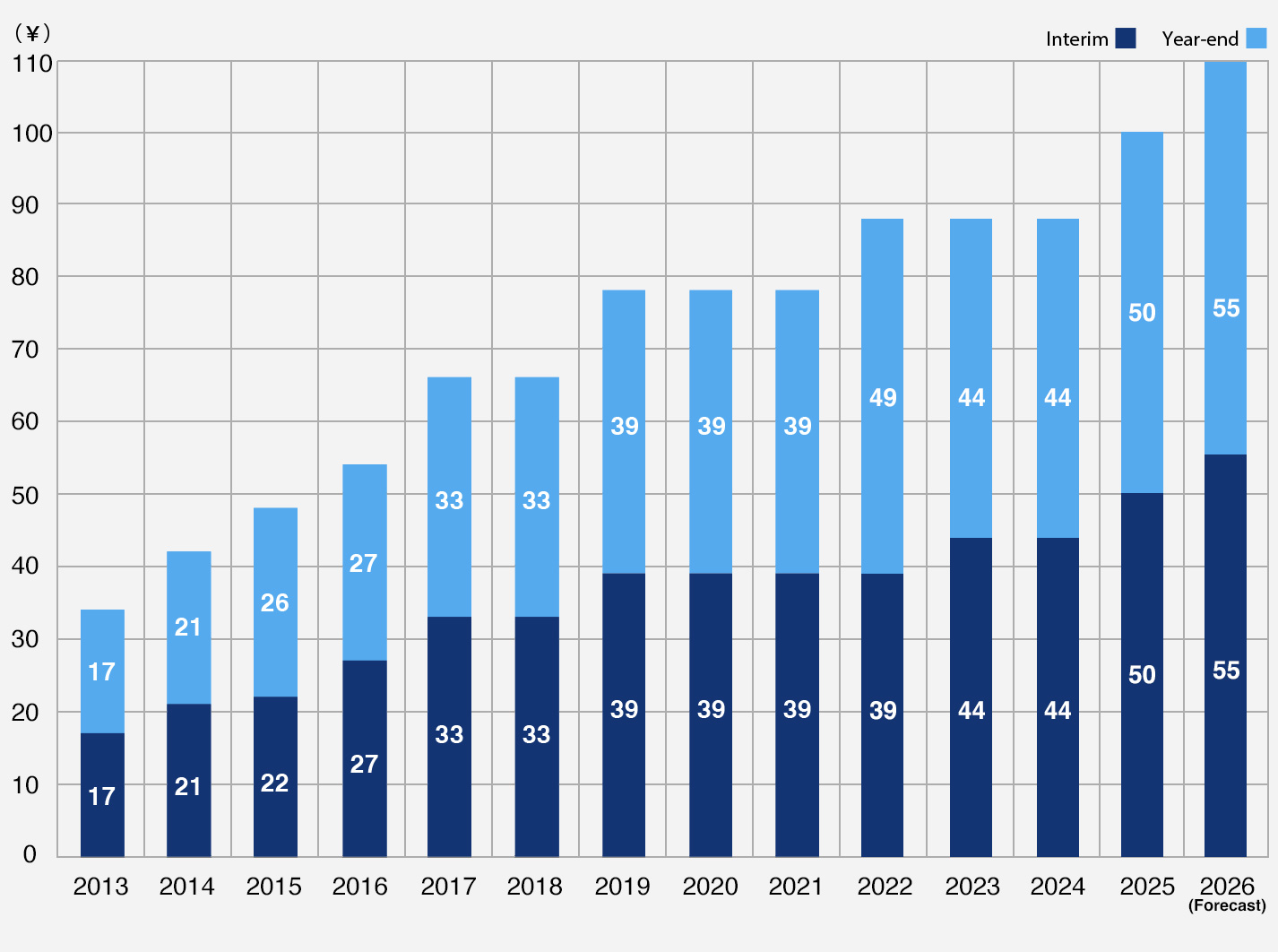

The Company positions the enhancement of shareholder returns as one of its most important management issues and strives to realize a distribution profits while also strengthening its management foundations. With this in mind, the Company has decided, in principle, not to reduce dividends until the fiscal year ending March 31, 2027, or the final year of the ongoing medium-term business plan LSV 2030 - Stage 2 (April 2024 to March 2027). It will pay dividends with a view to achieving a payout ratio of at least 40% or a DOE (dividend on equity ratio) of approximately 3%. Internal reserves are used effectively to reinforce the Company's financial base and provide increased future corporate value through investment in production facilities and R&D.

Change of Dividends

| (Years ended/ending March 31) | Cash dividends per share (¥) | Dividend payout ratio (Consolidated) (%) | ||

|---|---|---|---|---|

| Interim | Year-end | Annual | ||

| 2026 (Forecast) | 55 | 55 | 110 | 41.2 |

| 2025 | 50 | 50 | 100 | 47.2 |

| 2024 | 44 | 44 | 88 | 114.8 |

| 2023 | 44 | 44 | 88 | 52.4 |

| 2022 | 39 | 49 | 88 | 37.9 |

| 2021 | 39 | 39 | 78 | 49.4 |

| 2020 | 39 | 39 | 78 | 58.6 |

| 2019 | 39 | 39 | 78 | 43.5 |

| 2018 | 33 | 33 | 66 | 42.3 |

| 2017 | 33 | 33 | 66 | 41.6 |

| 2016 | 27 | 27 | 54 | 35.7 |

| 2015 | 22 | 26 | 48 | 29.7 |

| 2014 | 21 | 21 | 42 | 36.8 |

| 2013 | 17 | 17 | 34 | 33.1 |