- HOME

- Investor Relations

- Management Policies

- Corporate Governance

Jun. 20, 2025

Basic Philosophy

The Group believes that the fundamentals of corporate governance are to achieve thorough legal compliance, to increase management transparency and promote corporate ethics, and to make prompt decisions and effectively execute operations. By enhancing and reinforcing corporate governance, we aim to further increase our corporate value and joint profits with shareholders.

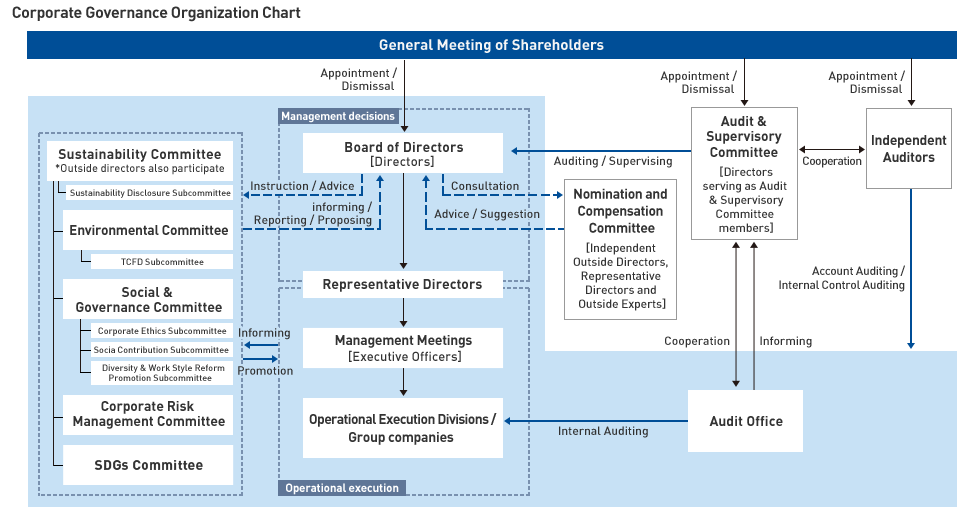

Corporate Governance System

- Corporate Governance System

The Company has selected the Company with Audit & Supervisory Committee system described in the Companies Act of Japan for its organizational structure. The Company has placed directors that are also Audit & Supervisory Committee members with voting rights on its Board of Directors in order to strengthen the Board’s supervisory function, with a view to stepping up corporate governance and to streamlining management even further. The Company has appointed 12 directors, of whom three are Audit & Supervisory Committee members and five are outside directors.

Held once a month to make important decisions with regard to management, Board of Directors’ meetings are also held on an ad hoc basis as necessary to strive for rapid decision making. Primarily comprising executive officers (including directors serving concurrently) responsible for the execution of business, management meetings are also held once a month and endeavor to streamline business operations through the sharing of information among all business divisions.

The Audit & Supervisory Committee meets once a month and conducts monitoring audits that focus on matters reported from the Audit Office, which is the Company’s internal audit division. In addition to performing audits covering the appropriateness and legality of the execution of directors’ duties, each and every Audit & Supervisory Committee member also plays a role in supervising the execution of the directors’ duties through the exercise of the voting rights on the Board of Directors.

・ Evaluation of Board of Directors’ effectiveness

In April 2025, the Company conducted an evaluation of the effectiveness of the Board of Directors. Details are as follows.

(Overview)

All directors were surveyed by questionnaire concerning the effectiveness of the Company's Board of Directors, with space provided for open-ended responses. To make the Board of Directors more effective still, we drew on third-party governance research, prepared a list of items for which our results are lower than the average for companies subject to this research in the form of proposed initiatives, and asked the directors what they believe should be prioritized and their opinions concerning these proposals. The Representative Director analyzed and evaluated the results obtained, identified specific issues, and determined which should be prioritized during the current term. In this way, the Company's independent Outside Directors evaluated the effectiveness of the Board of Directors as a whole.

- Determining questions and methods for evaluating the effectiveness of the Board of Directors

Questionnaire items are independently determined by the Company based on third-party governance research. While the Company's score is significantly higher than the average score for companies participating in the research, scores for certain items have fallen. We therefore formulated a questionnaire that lists various proposals for initiatives for these items, three of which we view as high priority items; ideas for initiatives to improve governance; and other items that allow for the free expression of opinions. We believe this approach to inquiring about priorities for improving Company governance, based on objective information, is reasonable. Additionally, we believe our approach to these evaluations is a reasonable method for evaluating the effectiveness of the Board of Directors as the questionnaire is designed based on objective scores, the Company's executive departments will formulate and implement additional measures to improve the effectiveness of the Board of Directors based on the questionnaire results obtained, and ultimately also because these procedures have been verified by independent Outside Directors, including Audit & Supervisory Committee members. - Evaluating the effectiveness of the Board of Directors based on responses to the questionnaire

- (i) Progress report on measures based on last fiscal year's effectiveness evaluation

Below is a summary of the matters reported at the Board of Directors meeting: Specifically, regarding (a), which concerns our business portfolio, discussions on optimizing the business portfolio have begun, and explanations of the current situation and the challenges facing each business unit have started to be provided at Board of Directors meetings. This is not a one-year measure, as discussions are to continue going forward. Regarding (b), which concerns the development of executives, the Nomination and Compensation Committee will continue to explore ways to develop executives as a theme for the current fiscal year. For human capital management in general, kaizen activities at each business site, which are based on the results of employee surveys, are ongoing. Further improvements are being made in the fellow system and in other systems. Regarding (c), which concerns investor relations, progress is currently underway in the form of briefings for individual investors and other initiatives. Finally, regarding (d), which concerns other ideas for improving governance (global governance and empowering Outside Directors to play more active roles), training to strengthen global governance has begun for employees who are about to be dispatched abroad. Rules concerning overseas assignments are being codified. Twice-yearly meetings between Outside Directors and executive officers will be organized to allow the exchange of opinions among these individuals. All these measures address important issues and must be implemented on an ongoing basis. It is therefore commendable that deliberations and execution are ongoing, with the participation of independent Outside Directors, and that the proposed measures have been appropriately implemented. - (ii) Measures for the current fiscal year

Based on this year's questionnaire, the Company included the following items in its list of top priority themes: (a) consideration of the nature of theme-setting itself at meetings of the Board of Directors to invigorate discussion by the Board of Directors, the broadening of materials distributed in advance of meetings, reviews of executives’ explanations, use of data, and still deeper discussion of ways to optimize the business portfolio; (b) further work on succession plans; and (c) approaches to communication and disclosure to strengthen disclosure concerning CO2 emissions. The theme selections and policy proposals were specific, reflecting the opinions of directors as determined from their questionnaire responses, and rational and reasonable measures have been proposed. As was the case in the previous term, since all of these measures should be implemented continuously, not just over the course of a single fiscal year, progress will be monitored and evaluated by the Outside Directors.

- (i) Progress report on measures based on last fiscal year's effectiveness evaluation

Based on these evaluations, the Company will continue to strengthen the environment for making the Board of Directors still more effective.

・ Director Training Policies

- New director training

After assuming their position, new directors are provided training from outside institutions to endow them with the legal, accounting, and other knowledge necessary to management. - Regular training

Twice a year, directors undergo training on contemporary issues from lawyers or other outside lecturers. These training sessions serve as opportunities to hone the sense of judgment that is crucial to members of the Board of Directors. - Special training

When necessary, directors participate in seminars at the Company’s expense to acquire the specialized insight required to perform their duties.

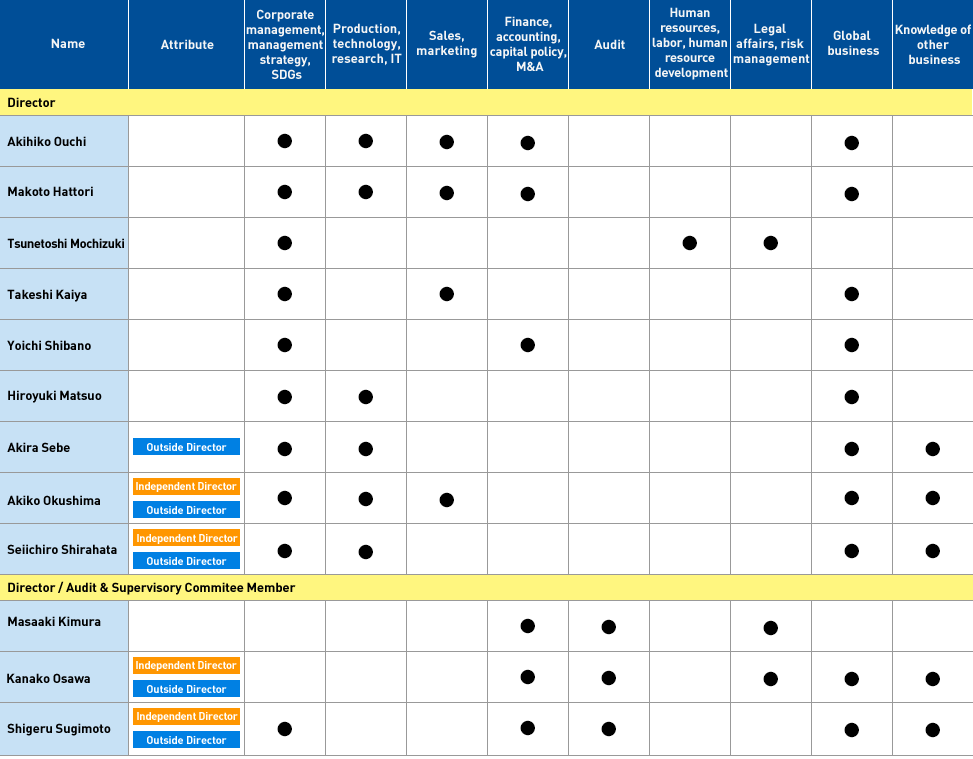

・ Director Expertise

The following table shows the fields in which each director is expected to make an especially strong contribution.

* The above table does not indicate all of the knowledge of each director.

- Determining questions and methods for evaluating the effectiveness of the Board of Directors

- Internal Control System

The following is an explanation of the internal control system to ensure that the execution of directors’ duties is in compliance with laws and regulations as well as the Articles of Incorporation, and the system to ensure the appropriateness of the execution of other corporate business.

・ System to ensure that the execution of the duties of directors and employees is in compliance with laws and regulations as well as the Articles of Incorporation

To ensure that the execution of the duties of directors and employees is in compliance with laws and regulations as well as the Articles of Incorporation and that a sense of ethics is maintained, the Company established its motto of “Sincerity and Creativity,” on which its Code of Conduct was based. To ensure the effectiveness of the compliance system with regard to laws and regulations as well as the Articles of Incorporation, the Audit Office—an organization under the president’s direct supervision—investigates and verifies, by means of audits based on the Internal Audit Regulations, whether all of the Company’s operations are being appropriately and reasonably implemented and pursuant to laws, the Articles of Incorporation, and internal rules and regulations. The results of those audits are regularly reported to the Board of Directors.

・ System for storing and managing information related to the execution of directors’ duties

Documents are stored and managed in accordance with rules determined for each document type, including those documents stipulated by law.

・ Regulations and other systems pertaining to management of risks of loss

By promoting the issuance of manuals by division and facilitating their thorough use, the Company makes preemptive efforts to reduce or avoid risk. In the case of specific risks, the Company promotes reviews of and improvements to response measures as risks arise. For emergency situations, such as the occurrence of a disaster, the Company has established the LINTEC Group Crisis Management Regulations, in addition to a BCMS, which is based on these regulations. These are separate from risk management initiatives conducted through normal operations, and we strive to ensure that a crisis management organization can be quickly established in the event of an emergency.

・ System to ensure that the execution of the duties of directors is efficiently conducted

In addition to setting out the duties for which directors are responsible for and that correspond to the allocation of roles of each organization, based on the Regulations on the Division of Duties, the Company works to separate management from execution and accelerate decision making by the introduction of an executive officer system. Moreover, the Company reviews internal organizations as necessary to be able to respond to environmental changes and works to maintain efficiency in the execution of the duties of directors by such means as the setting up of cross-organizational committees on an as-required basis.

・ System to ensure the appropriateness of business in the corporate group comprising the Company and its subsidiaries

Based on the Affiliate Company Operational Regulations, the Company works to maintain the appropriateness of its operations as a group entity by having each of its principal business divisions control the operations of Group companies. Based on the Affiliate Company Operational Regulations, the Company works to maintain a system for receiving corporate performance, risk, and other important reports from each Group company regularly or on an as-required basis. Providing business management and support from the appropriate division as necessary, the Company promotes management efficiency in each company. To ensure that Group companies are in compliance with laws and regulations as well as the Articles of Incorporation, audits are conducted by each company’s internal audit system and by the Company’s Audit Office.

・ Matters relating to the employees who are tasked to assist the duties of the Audit & Supervisory Committee, matters relating to the independence of said employees from directors, and matters relating to ensuring the effectiveness of Audit & Supervisory Committee instructions with respect to said employees

To further raise the effectiveness of Audit & Supervisory Committee audits and maintain a system to carry out audit duties more smoothly, the Company has established the Audit & Supervisory Committee secretariat, which supports and takes on Audit & Supervisory Committee duties. It is assumed that the Audit & Supervisory Committee’s consent has to be obtained for transfers of personnel to the Audit & Supervisory Committee secretariat staff, personnel evaluations, and disciplinary action. The instructions and orders given to Audit & Supervisory Committee secretariat staff are also deemed to be given by directors serving as Audit & Supervisory Committee members. With regard to said instructions and orders received from Audit & Supervisory Committee members, with the exception of those instructions and orders that are not necessary for the duties of Audit & Supervisory Committee members, it is assumed that Audit & Supervisory Committee secretariat staff do not receive instructions and orders from directors or other employees.

・ System relating to the reporting of cases to the Audit & Supervisory Committee and system for ensuring that the submitting of such reports is not seen as reason enough for the person who submitted them to be subjected to disadvantageous treatment

With regard to cases that are likely to significantly damage the Company or a Group company, such as violations of laws or regulations, all Group directors and employees are to report such cases to the Company’s Audit & Supervisory Committee. In addition, it is deemed that the Audit & Supervisory Committee will be able to directly demand business-related reports for all Group directors and employees. Under the Company’s Internal Reporting System Operation Regulations and its Global Internal Reporting System Regulations, the Company has established a helpline that can be used by all Group directors and employees and endeavors to maintain a system to ensure that the submitting of such reports is not seen as reason enough for the person who submitted said notification or report to be subjected to disadvantageous treatment. In the event of an internal notification via the helpline, this will be reported to the Audit & Supervisory Committee.

・ Matters concerning policy relating to the handling of costs or liabilities arising from the execution of duties of Audit & Supervisory Committee members

When an Audit & Supervisory Committee member invoices the Company for the prepayment or redemption of expenses incurred for the execution of their duties, said costs or liabilities will be promptly handled following discussions in the department responsible, with the exception of cases in which said costs have been recognized as being not necessary for the execution of said Audit & Supervisory Committee member’s duties. In addition, should Audit & Supervisory Committee members deem that independent outside experts (such as lawyers, certified public accountants, etc.) are necessary as advisers to the Audit & Supervisory Committee, the Company will bear those costs, with the exception of cases in which said costs have been recognized as being not necessary for the execution of said Audit & Supervisory Committee’s duties.

・ Other systems for ensuring that the Audit & Supervisory Committee carries out audits effectively

With a view to ensuring a system so that Company information reaches the Audit & Supervisory Committee unhindered, the Company works to maintain an environment in which information is received not only from directors (excluding directors serving as Audit & Supervisory Committee members) and from employees but also from independent auditors, corporate lawyers, tax accountants, and other specialists. The Company has a system in place to ensure regular meetings with representative directors and venues for important discussions, such as management and strategy meetings, for Audit & Supervisory Committee members to attend and state opinions.

- Basic Policies and Systems for Preventing Relationships with Antisocial Forces

The Company stands in firm opposition to all antisocial forces and organizations that threaten to disrupt the order and safety of civil society while practicing a strict policy of non-association with such entities. We have made this commitment clearly apparent in the LINTEC Compliance Guideline and are taking steps to ensure thorough awareness with this regard among all directors and employees.

We reject any illegitimate requests from antisocial forces and organizations and maintain close collaborative relationships with the police, centers for the removal of criminal organizations, lawyers, and other specialists to combat such requests. Should we be approached by antisocial forces or organizations, we will closely coordinate with such institutions, organizations, lawyers, or other specialists to furnish a quick, organization-wide response.

- Risk Management System

The Company has established the LINTEC Group Crisis Management Regulations as well as a risk management system for minimizing the possible impact and damage to corporate value if a major problem arises. It has also implemented and oversees the Information Security Management Rules and the Trade Secret Management Rules for the preservation and management of information. There are also Companywide risk assessments centered on the Corporate Risk Management Committee.

- Limited Liability Contracts

In accordance with Article 427, Paragraph 1 of the Companies Act, the Company has entered into a contract with each of its non-executive directors—outside directors Takanori Sano, Akiko Okushima, Seiichiro Shirahata, Kanako Osawa and Shigeru Sugimoto—that limits liability for compensation for damages under Article 423, Paragraph 1 of the Companies Act. Based on this contract, liability for compensation for damages is limited to ¥10 million or the minimum liability amount stipulated by law, whichever is greater.

-

Content of General Liability Insurance Policies for Directors

The Company has taken out general liability insurance policies for its directors based on Article 430 (3)-1 of the Companies Act. This insurance covers any legal compensation for damages and legal costs in the event that the insured person engages in behavior that is subject to damage claims during the term of insurance coverage. However, if the insured person illegally receives profits or benefits, conducts criminal acts, fraud, or deception, or violates other laws and regulations, the insurance policies will not provide any compensation for damages.

The persons insured under the insurance policies are directors, auditors, and executive officers of the Company and its subsidiaries, and persons in similar positions as defined by the laws and regulations of the countries where subsidiaries have been established. For all insured persons, the Company pays the full amount of the insurance premium.

- Basic policy on control of joint stock companies

The Company requires that those who make or intend to make large-scale purchases of Company shares provide necessary and sufficient information to shareholders, thereby allowing them to properly assess the pros and cons of the purchase in question, in accordance with applicable laws and regulations, for the purpose of maintaining the value of the Company as an enterprise and protecting the common interests of shareholders. For its part, the Company will disclose the opinions of the Company's Board of Directors and other relevant information and strive to provide shareholders with the time and information they need to consider such matters.

Should it find reasonable grounds to do so, the Company’s Board of Directors, which is entrusted with management responsibilities by the shareholders, shall promptly determine and implement specific countermeasures deemed appropriate against a large-scale purchase, to the extent permitted under applicable laws and regulations, thereby maintaining the value of the Company as an enterprise and safeguarding the common interests of its shareholders.

- Number of Members of the Board of Directors

The Company's Articles of Incorporation state that the number of members of the Board of Directors (excluding Audit & Supervisory Committee members) shall be 12 or fewer and that the number of directors who are Audit & Supervisory Committee members shall be 4 or fewer.

- Requirements for Appointment of Directors

The Company's Articles of Incorporation state that resolutions to appoint directors may be adopted by a majority of the voting rights of the shareholders in attendance if those shareholders hold one-third or more of the voting rights of the shareholders who can exercise their voting rights.

- General Meeting of Shareholders Resolution Matters that may be Resolved by the Board of Directors

To support rapid responses to changes in the management environment and flexible execution of various management measures, in regard to matters stipulated in each item of Article 459, Paragraph 1 of the Companies Act, such as dividends from surplus, etc., excluding cases in which there are special legal stipulations, the Articles of Incorporation state that these matters may be decided by resolution of the Board of Directors.

- Special Resolution Requirements for General Meeting of Shareholders

With the objective of enabling the smooth operation of General Meeting of Shareholders, the Company's Articles of Incorporation state that in regard to special resolution requirements for shareholders' meetings, as stipulated in Article 309, Paragraph 2 of the Companies Act, such resolutions may be adopted by at least two-thirds of the voting rights of the shareholders in attendance if those shareholders hold one-third or more of the voting rights of the shareholders who can exercise their voting rights.

Status of Outside Directors

- Outside Directors

The Company has appointed five outside directors— Takanori Sano, Akiko Okushima, Seiichiro Shirahata, Kanako Osawa and Shigeru Sugimoto. Two of these outside directors—Kanako Osawa and Shigeru Sugimoto—are Audit & Supervisory Committee members.

Name Human, Financial, and Business Relationships and Other Shared Interests between the Outside Directors and the Company Functions Performed and Roles Served by Outside Directors in the Company's Corporate Governance Takanori Sano Although there are no special interests between Takanori Sano and the Company, Nippon Paper Industries Co., Ltd. (“Nippon Paper” hereinafter), where he serves as General Manager of the Corporate Planning Division, is a key Company business partner, and in the fiscal year ended March 2025, the Company purchased raw materials, etc. worth ¥1,721 million from Nippon Paper, and sold products worth ¥60 million to Nippon Paper. Additionally, Nippon Paper is a major Company shareholder, currently holding 20,553,692 shares—30.51% of the total number of issued shares in the Company, excluding treasury shares—as of the end of March 2025. Given his knowledge and experience, gained through extensive business experience in administrative and sales departments at Nippon Paper Industries, he is ideally equipped to fulfill the mission of strengthening the supervisory functions of the Company’s Board of Directors and is thus a suitable candidate to serve as an Outside Director of the Company. He is a member of the Sustainability Committee. Akiko Okushima There are no particular shared interests between the Company and Akiko Okushima. By utilizing her know-how and experience gained through many years of work in a different industry from that of the Company as Representative Director and President, and her extensive knowledge in the field of marketing, Akiko Okushima is able to strengthen the Company’s Board of Directors’ supervisory function. Therefore, she has been appointed as an outside director. She is a member of the Sustainability Committee and Nomination and Compensation Committee. The Company has designated her as an independent officer based on the criteria stipulated by the TSE. Seiichiro Shirahata There are no particular shared interests between the Company and Seiichiro Shirahata. Based on his experience as an officer at Nippon Paint Holdings Co., Ltd. and its subsidiaries, and the knowledge and experience gained through his extensive experience as a person responsible for operational administration and business restructuring, he is ideally positioned to strengthen the supervisory function of the Company’s Board of Directors and well-suited to serve as an Outside Director of the Company. He is a member of the Sustainability Committee and the Nomination and Compensation Committee. In addition, the Company has designated him as an independent officer as defined by the TSE. Kanako Osawa There are no particular shared interests between the Company and Kanako Osawa. By utilizing her specialist expertise and extensive knowledge gained as an attorney, along with the knowledge and experience gained through her career in corporate legal affairs both at home and abroad, Kanako Osawa is able to strengthen the audit and supervisory functions of the Company’s Board of Directors. Therefore, she has been appointed as a director serving as an Audit & Supervisory Committee member. She is a member of the Sustainability Committee and Nomination and Compensation Committee, an advisory body to the Board of Directors. The Company has designated her as an independent officer based on the criteria stipulated by the TSE. Shigeru Sugimoto There are no particular shared interests between the Company and Shigeru Sugimoto. By utilizing his abundant business experience as an outside director and auditor in a sector different from the Company, even managing his own company, as well as his practical experience, broad knowledge, and advanced expert insight as a Certified Public Accountant, Registered Real Estate Appraiser, and Certified Tax Accountant, Shigeru Sugimoto is able to strengthen the audit and supervisory functions of the Company’s Board of Directors. Therefore, he has been appointed as a director serving as an Audit & Supervisory Committee member. He is a member of the Sustainability Committee and Nomination and Compensation Committee. The Company has designated him as an independent officer based on the criteria stipulated by the TSE. - The Company’s Basic Way of Thinking with Regard to the Independence of Outside Directors

The Company does not have its own set standards and policies with regard to the independence of outside directors and refers instead to the standards stipulated by the TSE. Since appointment is based on a request from the Company, we recognize that independence from management is to be ensured.

- Status of Outside Directors’ Supervision

In addition to attending Board of Directors’ meetings and making necessary and effective remarks as appropriate during agenda deliberations, outside directors attend meetings of the Internal Control Committee and oversee directors in the execution of their duties.

Status of Audits

- Status of Audit & Supervisory Committee Audits

The Company’s Audit & Supervisory Committee comprises three directors serving as Audit & Supervisory Committee members, of whom two are outside directors. While utilizing the internal control system, theAudit & Supervisory Committee cooperates with the Audit Offi ce and the independent auditor, receives thenecessary reports, and conducts audits of the directors’ business execution through such methods asexchanges of opinions. Each Audit & Supervisory Committee member attends management and othermeetings, obtains the information needed for the audits, attends Board of Directors’ meetings as a director,and supervises the directors in the execution of their duties by stating opinions and participating inresolutions through their voting rights. Mr. Masaaki Kimura, an Audit & Supervisory Committee Member, has extensive executive experience in the Company’s production, administration, and audit departments. Fellow Audit & Supervisory Committee Member Mr. Shigeru Sugimoto is a certified public accountant and certified tax accountant, so he possesses considerable knowledge of both finance and accounting. In the fiscal year under review, the Company convened the Audit & Supervisory Committee once a month or more and the attendance of individual Audit & Supervisory Committee members was as follows.

Name Total Number of meetings Number of meetings attended Masaaki Kimura 13 13 Kanako Osawa 13 13 Shigeru Sugimoto 13 13 The principal matters audited by the Audit & Supervisory Committee include the following: (1) in regard to the performance of directors, whether or not there are important cases of wrongdoing or violations of laws, regulations, or the Articles of Incorporation; (2) whether or not the details of the Board of Directors’ discussions regarding the internal control system, and the status of the establishment/operation of the internal control system, are reasonable; (3) whether or not the business reports, settlement related documents, etc., are in accordance with laws, regulations and the Articles of Incorporation and accurately show the Company’s circumstances; (4) whether or not the independent auditor’s audit methods and results are reasonable; and (5) whether or not a system to secure the proper execution of the duties of the independent auditor has been established. At the end of the period, the committee prepares an audit report that describes the audit methods and details as well as the audit results.

In addition, the activities of the full-time Audit & Supervisory Committee member include conducting Audit & Supervisory Committee audits of the head office, work sites, subsidiaries, etc., which are implemented in combination with the Audit Office’s internal audits; holding liaison meetings with the auditors of domestic and overseas subsidiaries; and sharing this information at meetings of the Audit & Supervisory Committee.

- Status of Internal Audits

The Company has established the Audit Office, an internal audit department with a staff of eight personnel. Internal audit personnel are required to gain the internal auditor qualification from the Institute of Internal Auditors. Based on the Internal Audit Rules, the Audit Office performs regular audits of each department, office, factory, and Group company from an objective standpoint, and regarding business execution processes and results, the Audit Office audits compliance with laws and regulations and the development and operation of the internal control system. The results of internal audits are fed back to the respective sites, to the departments that supervise these sites, and to headquarters, and the status of the improvements made is confirmed through subsequent periodic audits. In addition, based on the Internal Control Rules, the Audit Office evaluates the development and operation of internal controls related to financial reporting, and the results of these evaluations are discussed with the independent auditor and fed back to the relevant department. Progress in and the results of evaluations of the development and operation of internal controls related to financial reporting are shared with the Audit & Supervisory Committee and the independent auditor on an ad hoc basis. The Audit & Supervisory Committee receives an overview of the internal audit plan and reports on audit items in advance from the Audit Office, and after internal audits are conducted, all the audit results are reported to the Audit & Supervisory Committee. In addition, full-time Audit & Supervisory Committee members and the General Manager of the Audit Office work closely together, and engage in monthly liaison meetings during which they exchange opinions and information. Furthermore, the Audit Office makes periodic reports not just to the Audit & Supervisory Committee, but to the Board of Directors, keeping them up to date on the implementation of the internal audit plans, providing audit results from each site, informing them of progress on the internal control evaluations, and summarizing the results of these evaluations. This dual reporting mechanism helps ensure the effectiveness of the internal audits.

- Status of Accounting Audits

・ Name of audit firm

Ernst & Young ShinNihon LLC

・ Continuous period for which the independent auditor has performed audits

Since 1981

・ Certified public accountants who executed the audit

Designated limited liability partner Yoshihiro Sugimoto

Designated limited liability partner Tsuyoshi Kawamura・ Composition of the group of assistants involved with the audit

Assistants with accounting auditing comprise nine certified public accountants and 28 others.

・ Selection policy and reason for selection of audit firm

Each period, the Audit & Supervisory Committee conducts an evaluation in accordance with the standards for evaluation and selection of the independent auditor. The independent auditor is selected based on a comprehensive assessment of the independent auditor's independence, internal control system, audit plans, audit methods and results, and the status of execution of audit duties.

The Audit & Supervisory Committee may dismiss the independent auditor in any of the cases stipulated in Article 340, Paragraph 1 of the Companies Act, based on the agreement of all Audit & Supervisory Committee members. In that event, an Audit & Supervisory Committee member selected by the Audit & Supervisory Committee will provide a report of the dismissal and the reason for the dismissal at the first General Meeting of Shareholders convened after the dismissal.

In addition, in the event that the Audit & Supervisory Committee, with consideration for the status of the implementation of the independent auditor's duties, the Company's audit system, etc., determines that it is necessary to change the independent auditor, then the Audit & Supervisory Committee may decide the details of a proposal to the General Meeting of Shareholders concerning the dismissal or non-reappointment of the independent auditor.

・ Evaluation of audit firm by the Audit & Supervisory Committee

In accordance with the standards for evaluation and selection of the independent auditor, the Audit & Supervisory Committee will conduct evaluations from the perspective of the audit firm's quality control; audit team; audit compensation, etc.; communications with the Audit & Supervisory Committee; relationship with senior executives, etc.; Group audits, and misconduct risk.

- Details of Audit Remuneration, Etc.

・ Remuneration of the independent auditor, etc.

Category Fiscal year ended March 31, 2024 Fiscal year ended March 31, 2025 Remuneration for audit services (Millions of yen) Remuneration for non-audit services (Millions of yen) Remuneration for audit services (Millions of yen) Remuneration for non-audit services (Millions of yen) LINTEC 95 0 100 0 Consolidated subsidiaries - - - - Total 95 0 100 0 * The non-audit services provided to the Company in the previous fiscal year and the fiscal year under review were officer training.

・ Remuneration to the same network (Ernst & Young) as the independent auditor, etc. (excluding remuneration of the independent auditor, etc.)

Category Fiscal year ended March 31, 2024 Fiscal year ended March 31, 2025 Remuneration for audit services (Millions of yen) Remuneration for non-audit services (Millions of yen) Remuneration for audit services (Millions of yen) Remuneration for non-audit services (Millions of yen) LINTEC - 11 - 6 Consolidated subsidiaries 52 20 56 23 Total 52 31 56 30 * The non-audit services provided to consolidated subsidiaries in the previous fiscal year and the fiscal year under review were tax-related advisory services, etc.

・ Details of remuneration for other material audit services

Not applicable

・ Policy for determination of audit remuneration

In regard to audit remuneration for the Company's independent auditor, etc., an amount estimated from the number of planned audit days, etc., is decided with the agreement of the Company's Audit & Supervisory Committee.

・ Reason for agreement to the independent auditor's remuneration, etc., by the Audit & Supervisory Committee

The reason the Company's Audit & Supervisory Committee agreed to the remuneration, etc., for the independent auditor proposed by the Board of Directors, pursuant to Article 399, Paragraph 1 and Paragraph 3 of the Companies Act, is that the Audit & Supervisory Committee judged it to be appropriate following necessary verification by the Audit & Supervisory Committee of the details of the independent auditor's audit plan, the status of execution of the accounting audits, and the basis for the calculation of the audit remuneration.

Remuneration of Corporate Officers

- Policy Regarding Decisions on Amounts of Director Remuneration

The Company's basic policy is to determine remuneration for directors and the methods used to calculate such remuneration so that the amounts are appropriate given director roles and responsibilities and do not exceed the maximum amounts determined at the General Meeting of Shareholders. The specifics for each type of director are presented below. These policies are determined by the Board of Directors after the Nomination and Compensation Committee confirms their suitability.

・ Remuneration of directors (excluding outside directors and Audit & Supervisory Committee members)

Remuneration for directors (excluding Outside Directors and Audit & Supervisory Committee members) is composed of fixed remuneration (base remuneration) and a combination of performance-linked remuneration (bonuses), serving as short-term incentive remuneration and reflecting the Company's consolidated operating performance, and non-cash remuneration (restricted stocks), serving as long-term incentive remuneration to motivate directors to strengthen the Company's share price and enhance its value as an enterprise. The breakdown is approximately 63.5% base remuneration, 23% bonuses, and 13.5% restricted stocks. For representative directors, the incentive component is set higher: The breakdown is approximately 57.5% base remuneration, 25.5% bonuses, and 17% restricted stocks. To enhance objectivity and transparency in evaluations of directors (excluding Outside Directors and Audit & Supervisory Committee members) and in the determination of their remuneration, the Nomination and Compensation Committee provides advice and suggestions in consultation with the Board of Directors. (The Nomination and Compensation Committee is composed of all independent Outside Directors, all representative directors, and outside experts, and the chair is selected from the independent Outside Directors.)

- (Overview of remuneration structure)

- Slide to view.

Type of remuneration Payment criteria Payment method Share of total remuneration Representative directors Directors Fixed remuneration

(Base remuneration)Base remuneration set for each role Monthly Cash Approx.

57.5%Approx.

63.5%Performance-linked remuneration

(bonuses)Base amount of bonuses set for each role, with evaluations based on the following financial and non-financial indicators (KPIs) multiplied by the respective weights: Annually

CashApprox.

25.5%Approx.

23%Category KPIs Weights Financial indicators Consolidated net sales and consolidated operating profit 86.9% TSR (total shareholder return) 4.3% Non-financial indicators Status of CO2 emissions reductions 4.3% Engagement score 4.3% Non-monetary remuneration

(restricted stocks)Base monetary remuneration claim set for each role, with a base amount divided by the closing price on the day before the allocation resolution date in each fiscal year to determine the number of shares allocated Annually Shares Approx.

17%Approx.

13.5% - (Base remuneration)

- - Fixed amount set for each role, paid monthly

- - The total amount paid cannot exceed ¥420 million, including ¥30 million for Outside Directors (excluding Audit & Supervisory Committee members).

- (Bonuses)

- - Set as short-term incentive remuneration (performance-linked remuneration) reflecting consolidated operating performance

- - The total amount paid cannot exceed ¥150 million.

- - A base amount for bonuses is set for each role, with evaluations based on the following financial and non-financial indicators (KPIs) multiplied by the respective weights:

-

- (a) Calculation performed to reflect financial indicators: Consolidated net sales and consolidated operating profit

Consolidated net sales and consolidated operating profit, the figures in (i) and (ii) below, are each weighted at a 6:4 ratio, and evaluation is made based on the result of this calculation.- (i) Ratio of actual performance for the current term to forecasts announced publicly at the start of the term (i.e., the consolidated forecasts presented in the earnings briefing) (See Note.)

- (ii) Ratio of average performance for the period corresponding to the officer’s tenure during the most recent three years, including the current term, to average performance during the three years before the current term (Note)

Note: The Nomination and Compensation Committee is to be consulted in the event of significant differences in assumptions made when comparing the indicators to performance figures due to the completion of M&A transactions, changes in accounting policies, or other such factors. Appropriate adjustments, if any, are to be made following an assessment of the situation.

- (b) Calculation intended to reflect financial indicators: TSR (total shareholder return)

The TSR for the fiscal year concerned is compared to the TOPIX including dividends, and the resulting evaluation is based on the growth rate. - (c) Calculation intended to reflect non-financial indicators: Status of CO2 emissions reductions

To achieve our CO2 emissions reduction targets (Scopes 1 and 2)—to reduce CO2 emissions by 67% or more in Stage 2 and 75% or more in Stage 3 relative to FY2013 levels—we determine CO2 emissions for each fiscal year as part of our roadmap to 2030. Evaluation is then made based on whether actual emissions remain below target emissions for the fiscal year in question. - (d) Calculation intended to reflect non-financial indicators: Engagement score

The employee survey covers three core themes, “philosophy and strategy,” “organizational culture,” and “transformation activities,” and the evaluation is made based on whether the scores for each theme, plus the total score (four scores in all) in the survey for the fiscal year concerned increase from the previous year.

- (a) Calculation performed to reflect financial indicators: Consolidated net sales and consolidated operating profit

- (Restricted stocks)

- - Set as long-term incentive remuneration intended to boost director motivation to improve the Company’s share price and enhance its value as an enterprise

- - The total amount paid cannot exceed ¥80 million, including ¥10 million for Outside Directors, (excluding Audit & Supervisory Committee members).

The total amounts of the above types of remuneration were determined as follows by resolution at the General Meeting of Shareholders: base remuneration (127th meeting on June 21, 2021), bonuses (124th meeting on June 21, 2018), and restricted stocks (131st meeting on June 20, 2025).

・ Remuneration of outside directors (excluding Audit & Supervisory Committee members)

Remuneration for Outside Directors (excluding Audit & Supervisory Committee members) is composed of fixed remuneration (base remuneration) and non-cash remuneration (restricted stocks), serving as long-term incentive remuneration intended to boost director motivation to improve Company share price and enhance its value as an enterprise. The breakdown is approximately 91% base remuneration and 9% restricted stocks.

- (Overview of remuneration structure)

- Slide to view.

Type of remuneration Payment criteria Payment method Share of total remuneration Fixed remuneration

(Base remuneration)Base remuneration set for each role Monthly Cash Approx. 91% Non-monetary remuneration

(restricted stocks)Base monetary remuneration claim set for each role, with the base amount divided by the closing price on the day before the allocation resolution date in each fiscal year to determine the number of shares allocated Annually Shares Approx. 9% - (Base remuneration)

- - Fixed amount paid monthly

- - The total amount paid cannot exceed ¥30 million.

- (Restricted stocks)

- - Set as long-term incentive remuneration intended to boost director motivation to improve Company share price and enhance its value as an enterprise

- - The total amount paid cannot exceed ¥10 million.

The total amounts of the above types of remuneration were determined as follows by resolution at the General Meeting of Shareholders: base remuneration (127th meeting on June 21, 2021) and restricted stocks (131st meeting on June 20, 2025).

・ Remuneration of directors (Audit & Supervisory Committee members)

Remuneration for directors (Audit & Supervisory Committee members) is composed of fixed remuneration (base remuneration) and non-cash remuneration (restricted stocks), serving as long-term incentive remuneration intended to boost director motivation to improve Company share price and enhance its value as an enterprise. The breakdown is approximately 91% base remuneration and 9% restricted stocks.

- (Overview of remuneration structure)

- Slide to view.

Type of remuneration Payment criteria Payment method Share of total remuneration Fixed remuneration

(Base remuneration)Base remuneration set for each role Monthly Cash Approx. 91% Non-monetary remuneration

(restricted stocks)Base monetary remuneration claim set for each role, with the base amount divided by the closing price on the day before the allocation resolution date in each fiscal year to determine the number of shares allocated Annually Shares Approx. 9% - (Base remuneration)

- - Fixed amount paid monthly

- - The total amount paid cannot exceed ¥60 million.

- (Restricted stocks)

- - Set as long-term incentive remuneration intended to boost director motivation to improve Company share price and enhance its value as an enterprise

- - The total amount paid cannot exceed ¥10 million.

The total amounts of the above types of remuneration were determined by resolution at the General Meeting of Shareholders as follows: base remuneration (121st meeting on June 24, 2015) and restricted stocks (131st meeting on June 20, 2025).

- (Overview of remuneration structure)

-

Matters regarding determination of remuneration and others for individual officers

The Company’s Board of Directors determines internal rules governing director remuneration after the Nomination and Compensation Committee confirms their propriety. Base remuneration is paid in accordance with these internal rules. Bonuses are calculated in accordance with the internal rules and determined by resolution of the Board of Directors after the Nomination and Compensation Committee confirms the propriety of the amounts and the processes applied to calculate/determine the amounts. For restricted stocks, the number of shares allocated is determined by resolution of the Board of Directors in accordance with the resolution of the 131st General Meeting of Shareholders held June 20, 2025, and the internal rules.

- Total Remuneration by Corporate Officer Type

- Slide to view.

Corporate officer type Total

remuneration

(Millions of yen)Total remuneration by type

(Millions of yen)Number of

people

receiving

remunerationBasic

remunerationBonuses Restricted

stocksDirectors

(excluding Audit & Supervisory Committee members and outside directors)315 209 76 28 6 Directors

(Audit & Supervisory Committee members)

(excluding outside directors)21 21 - - 1 Outside officers 44 44 - - 6

Policy on Holdings of Capital Tie-Up Shares

The Company views the establishment and maintenance of stable, long-term relationships with business partners as a matter of importance. For this reason, shares of business partners are held strategically based on a comprehensive evaluation of factors such as the Company’s business relationship with the partner in question. The company only acquires such shares when increasing trust and coordination with the business partner is judged as an effective means of mutually raising corporate value. These holdings are reviewed based on this perspective when necessary, and consideration is given to reducing them. The Company evaluates the suitability of holding all cross-shareholdings at meetings of the Board of Directors in February or March, considering for each stock the importance of specific business relationships and other factors. Where no clear rationale for holding a stock can be confirmed, the Company will proceed to reduce the numbers of shares held after engaging in dialogue with the issuing company. When exercising voting rights, the Company will consider, from a wide-ranging perspective, whether the proposed resolutions presented by business partners will increase shareholder value.

Stockholdings

- Criteria for and Approach to the Classification of Investment Shares

The Company classifies investment stocks held with the objective of receiving profits through stock price fluctuations or stock-related dividends as stocks held for pure investment purposes, and other stocks as investment stocks held for purposes other than pure investment (Capital Tie-Up Shares).

- Stocks Held for Purposes other than Pure Investment

・ Number of issues and amount recorded on balance sheet

Number of issues (issues) Total amount recorded on balance sheet (Millions of yen) Unlisted shares 11 67 Shares other than unlisted shares 22 1,720 ・ Information related to number of shares, amount recorded on balance sheet, etc., for specified investment shares and deemed shareholdings, by issue (top 10 issues)

Issue Fiscal year ended March 31, 2025 Fiscal year ended March 31, 2024 Purpose of holding, quantitative effects of holding, and reasons for increase in the number of shares Whether or not investee holds shares of the Company Number of shares (shares) Number of shares (shares) Amount recorded on balance sheet (Millions of yen) Amount recorded on balance sheet (Millions of yen) Toray Industries, Inc. 580,000 1,160,000 A supplier, and in Converted Products Operations, it is a customer. The Company holds shares of Toray to maintain good business relationships. Yes 589 858 Mitsubishi UFJ Financial Group, Inc. 159,710 159,710 The Group's primary banking partner. The Company holds shares of MUFG Bank to maintain good business relationships. Yes 321 248 IMURA & Co., Ltd. 200,000 200,000 A customer in Fine & Specialty Paper Products Operations. The Company holds shares of IMURA to maintain good business relationships. Yes 194 214 KING JIM CO., LTD. 130,430 130,430 A customer in Fine & Specialty Paper Products Operations. The Company holds shares of KING JIM to maintain good business relationships. Yes 112 117 Fujipream Corporation 312,000 578,300 A partner in the manufacturing division. The Company holds shares of Fujipream to maintain good business relationships. No 107 243 Mizuho Financial Group, Inc. 20,695 20,695 The Group's primary banking partner. The Company holds shares of Mizuho Bank to maintain good business relationships. Yes 83 63 SANKO SANGYO CO., LTD. 152,432 152,432 A customer in Printing & Variable Information Products Operations. The Company holds shares of SANKO SANGYO to maintain a good business relationship. No 58 64 ASAHI PRINTING CO., LTD. 57,468 52,537 A customer in Printing & Variable Information Products Operations. The Company holds shares of ASAHI PRINTING through its stock ownership plan to maintain a good business relationship.

The number of shares held has increased because the Company has acquired shares through ASAHI PRINTING's stock ownership plan.No 51 47 Arisawa Mfg. Co., Ltd. 35,431 35,431 A customer in Converted Products Operations. The Company holds shares of Arisawa Mfg to maintain good business relationships. No 49 40 Canon Marketing Japan Inc. 6,938 6,938 A customer in Industrial & Material Operations. The Company holds shares of Canon Marketing Japan to maintain good business relationships. No 35 31

Takeover Defense Measures

The Company has not introduced takeover defense measures. However in regard to persons who are engaging in or aim to engage in a large-scale purchase of the Company's stock, the Company will act from the perspective of securing its corporate value and the common interests of its shareholders. From that perspective, the Company will request that persons who are engaging in or aim to engage in a large-scale purchase provide necessary and sufficient information to allow the shareholders to appropriately determine the pros and cons of the large-scale purchase in accordance with relevant laws and regulations. At the same time, the Company will disclose the opinions of the Board of Directors and endeavor to secure necessary time and information for the shareholders to consider such large-scale purchase. Further, if it is rationally judged that there is a risk of damage to the Company’s corporate value and the common interests of shareholders unless timely defensive measures are implemented to address a large-scale purchase, the Company will endeavor to secure its corporate value and the common interests of its shareholders, as an obvious obligation of the Board of Directors entrusted with management of the Company by its shareholders, by promptly deciding the content of the concrete measures deemed most appropriate at the time in accordance with the relevant laws and regulations and executing such measures.

Interactions with Shareholders and Other Investors

The Company seeks to engage in constructive interactions with shareholders and other investors that contribute to sustainable growth and medium- to long-term improvements in corporate value. The Company has established an investor relations (IR) activity system and advances proactive initiatives.

- System

The officer responsible for IR implements and oversees the Company’s various IR activities, including individual meetings with shareholders and investors. In regard to responses to requests for individual meetings, members of senior management or directors will meet with shareholders or investors requesting meetings based, whenever appropriate, on the desires and interests of the requester.

The Public Relations Office, Finance & Accounting Dep., General Affairs & Legal Dep., and Corporate Strategic Office will play a central role in advancing the Company’s various IR activities. Relevant divisions pursue close coordination with these offices and departments, exchanging information on a daily basis and meeting with members of senior management as appropriate to share necessary information.

- IR events for FY2024

In addition to individual meetings, the Company’s IR activities include regular briefings on financial results and medium-term business plans, visits to overseas investors, participation in IR conferences at which overseas investors gather, facility tours, business explanatory forums, and Company briefings for individual investors. We seek to expand the range of information provided to domestic and overseas shareholders and other investors by publishing shareholder newsletters and integrated reports and posting information in the IR section of our corporate website. At the same time, we collect feedback from a wide range of shareholders and other investors through surveys that are attached to shareholder newsletters and made available on the IR website.

- Slide to view.

Major IR events Frequency Person who primarily handled the event Interviews and meetings 311 companies President and CEO, Director, Executive Officer, Public Relations Office Staff Financial Results Briefings Twice President and CEO, Director, Executive Officer International IR Once President and CEO, Director, Executive Officer Conferences sponsored by brokerage firms Once President and CEO, Director, Executive Officer Briefing for individual investors Once President and CEO -

Main themes and concerns for dialogue with shareholders and investors in FY2024

- ・Overseas subsidiary performance

- ・Sales performance and future demand trends of Advanced Materials Operations

- ・Progress of new product development and timing of contribution to business performance

- ・Profit improvement of Optical Products Operations and Fine & Speciality Paper Products Operations

- ・Status of internal discussions and considerations regarding measures to improve PBR below 1

- Status of feedback to management and the board of directors

Opinions and concerns of shareholders and other investors solicited through IR activities are relayed to management by the relevant divisions via quarterly business reports at the Board of Directors’ meetings and reviewed each fiscal year. They are reported appropriately to management on an as-required basis.

- Information management and quiet periods

In interactions with shareholders and other investors, we practice stringent management of information in accordance with the internal Insider Trading Prevention Regulations to ensure that insider information is not disclosed. In addition, the Company’s disclosure policy stipulates that we will observe a quiet period that begins approximately one month prior to the announcement of quarterly financial results to avoid leaks of financial results and to maintain fairness. During this period, we will not answer questions or make comments on our financial results and forecasts.