- HOME

- Investor Relations

- Financial Data

- Performance Highlights

| Consolidated | FY2025/3(results) | |

|---|---|---|

| Net Sales | 315,978 | 14.4% |

| Operating Income | 24,562 | 131.1% |

| Ordinary Income | 26,090 | 126.1% |

| Profit Atributable to Owners of Parent | 14,476 | 176.1% |

% is Year on Year

Performance overview for the fiscal year ended March 31, 2025

During the current consolidated fiscal year, the US economy remained firm, supported by strong growth in personal consumption and capital investment. In contrast, economic growth in Europe remained sluggish. In China, despite government stimulus measures, the economy continued to face difficulties due to weak personal consumption and a downturn in the real estate market. In Japan, although the increase in inbound tourism provided some positive momentum, a sense of stagnation persisted amid sluggish personal consumption caused by higher prices of food and other essentials, frequent natural disasters, and a decline in automobile production. Under these circumstances, the performance of the Company and its consolidated subsidiaries businesses was favorable overall, due mainly to a significant increase in sales, driven by strong demand for semiconductor and electronic component-related products and recovery in sales volumes of adhesive products for seals and labels in the United States. In terms of profitability, although the price of fuel and raw materials and cost of logistics continued to rise, higher sales volumes of various products including semiconductor and electronic component-related products contributed to increased profits.

Segment overview for the fiscal year ended March 31, 2025

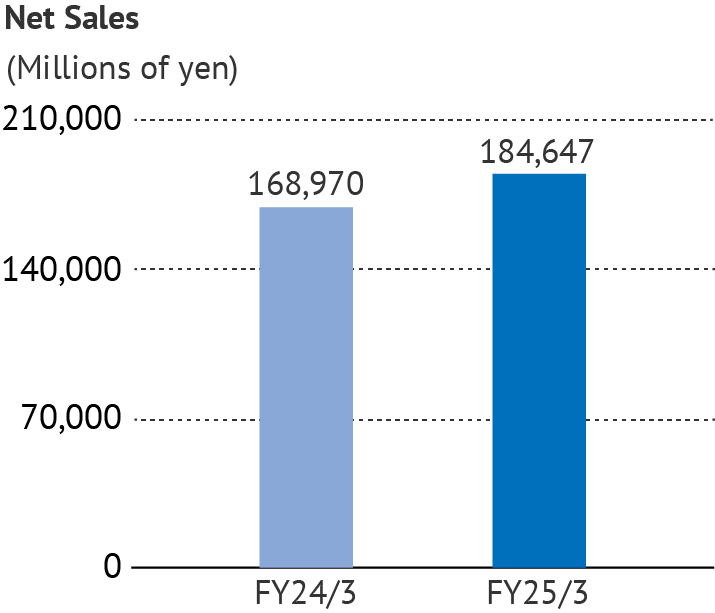

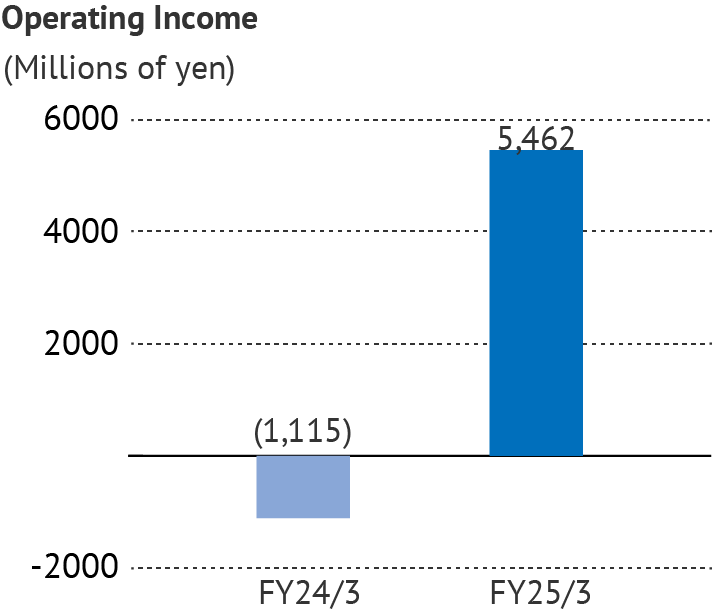

| Printing and Industrial Materials Products (Year on Year) | |

|---|---|

| Net Sales |

¥184,647

million (up 9.3%)

|

| Operating Income |

¥5,462

million (-) |

| Printing & Variable Infomation Products Operations (Year on Year) | |

|---|---|

| Net Sales |

¥146,665

million (up 10.1%) |

As for adhesive products for seals and labels, demand, especially that related to food products, declined due to the impact of rising prices in Japan. In addition, sales of products for eye-catching labels and beverage campaigns were sluggish overall. Outside Japan, the United States saw a significant increase in sales volumes due to the effects of acquisitions. Likewise, demand was solid in China and in the ASEAN region.

| Industrial & Material Operations | |

|---|---|

| Net Sales |

¥37,981

million (up 6.1%) |

In Japan, sales of automobile-use adhesive products and window films proved sluggish due to a decline in automobile production. Overseas, sales of security window films and sputtering films were strong in the United States, and sales of automobile-use adhesive products increased in India.

Segment operating income

Operating income was 5,462 million yen (-% year-on-year), due mainly to a significant increase in sales volumes in the United States.

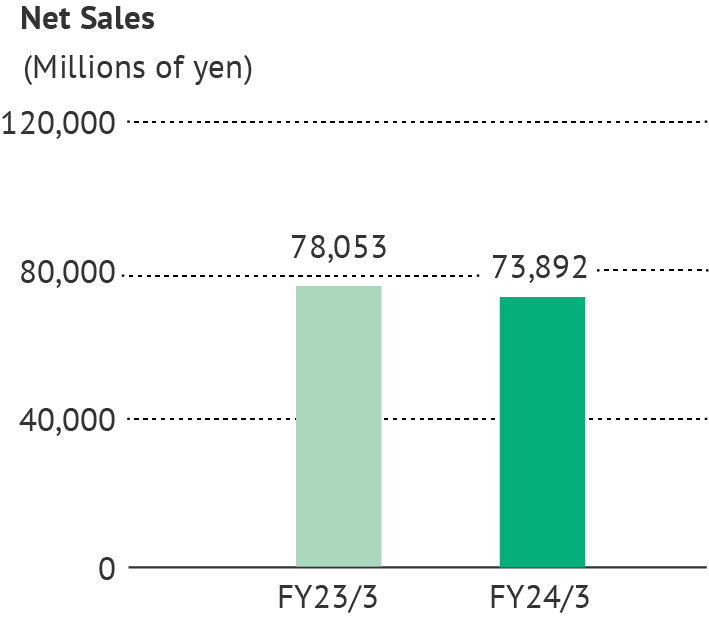

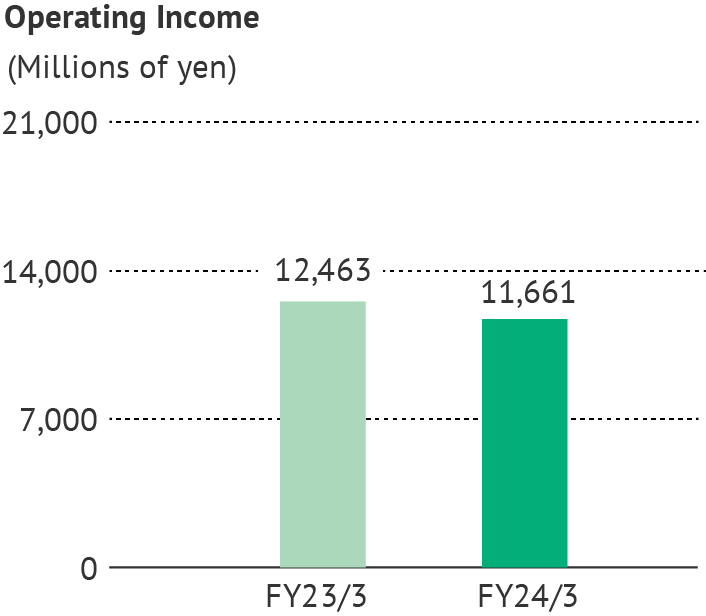

| Electronic and Optical Products (Year on Year) | |

|---|---|

| Net Sales |

¥96,312

million (up 30.3%) |

| Operating Income |

¥18,505

million (up 58.7%) |

| Advanced Materials Operations (Year on Year) | |

|---|---|

| Net Sales |

¥85,008

million (up 41.7%) |

Semiconductor-related adhesive tapes performed well due to reasons such as increased demand related to generative AI. Sales of semiconductor-related devices such as those for HBM manufacturing also experienced significant growth. Substantially higher sales were also seen for multilayer ceramic capacitor-related tape, driven by increased demand related to smartphones and data centers.

| Optical Products Operations (Year on Year) | |

|---|---|

| Net Sales |

¥11,303

million (down 18.8%) |

Although sales of adhesive tapes for OLED smartphones were solid, sales declined significantly due to the closure of subsidiaries in South Korea and Taiwan.

Segment operating income

The increase in sales volumes of semiconductor-related adhesive tapes resulted in an operating income of 18,505 million yen (up 58.7% year-on-year).

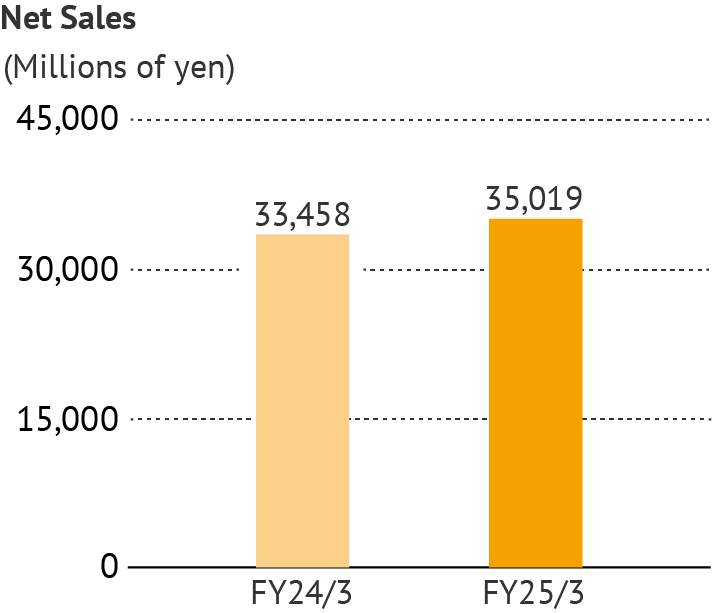

| Paper and Converted Products (Year on Year) | |

|---|---|

| Net Sales |

¥35,019

million (up 4.7%) |

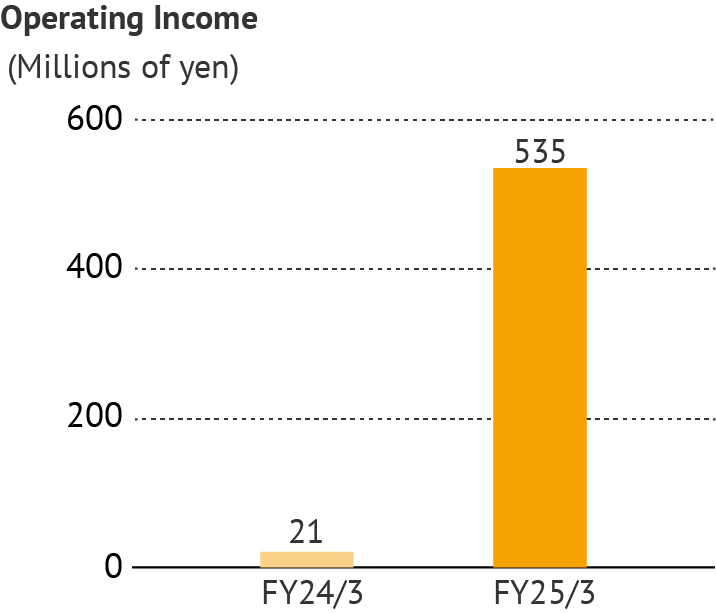

| Operating Income |

¥535

million (up 2,443.1%) |

| Fine & Speciality Paper Products Operations (Year on Year) | |

|---|---|

| Net Sales |

¥14,876

million (down 3.0%) |

Despite solid sales of dust-free papers and oil- and water-resistant papers, sales of core products like color papers for envelopes, colored construction papers, and construction material papers were sluggish due to lower demand.

| Converted Products Operations (Year on Year) | |

|---|---|

| Net Sales |

¥20,142

million (up 11.1%) |

Sales of release papers for electronic materials and release films for optical-related products were strong due to increased demand for smartphones and similar applications. Sales of casting papers for synthetic leather and casting papers for carbon fiber composite materials for leisure also experienced growth.

Segment operating income

Although the Fine & Specialty Paper Products Operations performed poorly in terms of profitability, segment operating income was 535 million yen (up 2,443.1% year-on-year), due mainly to an increase in sales volumes in Converted Products Operations.

Forecasts of consolidated business results for the fiscal year ending March 31, 2026

| Consolidated | FY2026/3(forecasts) | |

|---|---|---|

| Net Sales | 317,000 | 0.3% |

| Operating Income | 24,000 | (2.3%) |

| Ordinary Income | 24,000 | (8.0%) |

| Profit Atributable to Owners of Parent | 18,000 | 24.3% |

% is Year on Year