- HOME

- Investor Relations

- Stock & Bond Information

- Dividend Information

Basic Policies of Shareholder Returns

The Company positions the enhancement of shareholder returns as one of its most important management issues and strives to realize a distribution profits while also strengthening its management foundations. With this in mind, the Company has decided, in principle, not to reduce dividends for the four-year period from the fiscal year ending March 31, 2024, namely, the final year of the ongoing medium-term business plan LSV 2030 - Stage 1, to the fiscal year ending March 31, 2027, or the final year of the next medium-term business plan LSV 2030 - Stage 2 (April 2024 to March 2027). It will pay dividends with a view to achieving a payout ratio of at least 40% or a DOE (dividend on equity ratio) of approximately 3%. Internal reserves are used effectively to reinforce the Company's financial base and provide increased future corporate value through investment in production facilities and R&D.

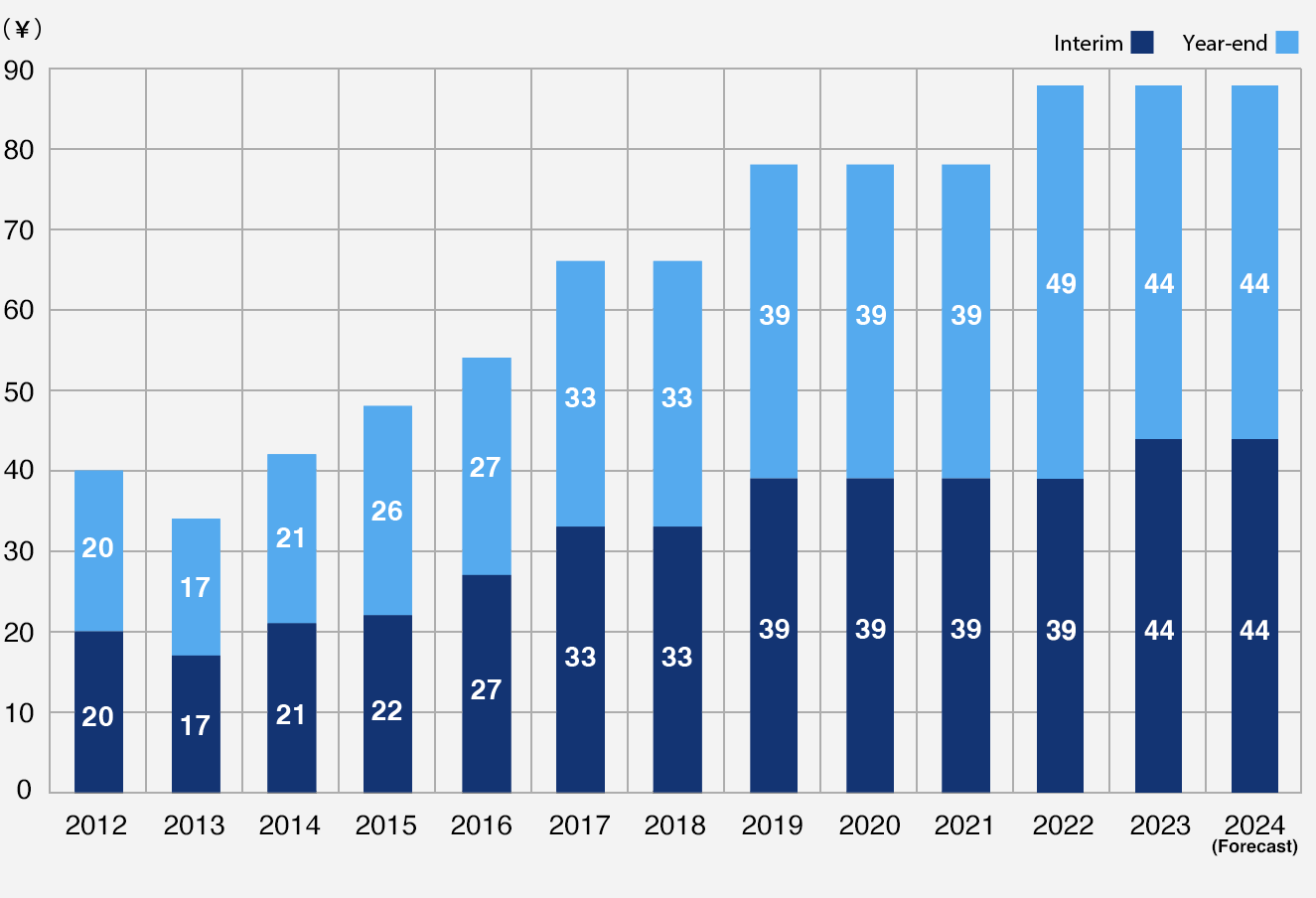

Change of Dividends

| (Years ended/ending March 31) | Cash dividends per share (¥) | Dividend payout ratio (Consolidated) (%) | ||

|---|---|---|---|---|

| Interim | Year-end | Annual | ||

| 2024 (Forecast) | 44 | 44 | 88 | 109.4 |

| 2023 | 44 | 44 | 88 | 52.3 |

| 2022 | 39 | 49 | 88 | 37.9 |

| 2021 | 39 | 39 | 78 | 49.4 |

| 2020 | 39 | 39 | 78 | 58.6 |

| 2019 | 39 | 39 | 78 | 43.5 |

| 2018 | 33 | 33 | 66 | 42.3 |

| 2017 | 33 | 33 | 66 | 41.6 |

| 2016 | 27 | 27 | 54 | 35.7 |

| 2015 | 22 | 26 | 48 | 29.7 |

| 2014 | 21 | 21 | 42 | 36.8 |

| 2013 | 17 | 17 | 34 | 33.1 |

| 2012 | 20 | 20 | 40 | 34.7 |